Back in 2001, when the legislature, once again, could not find a way to convince voters that raising the gas tax to keep pace with inflation might be a good idea, they instead created the Road User Fee Task Force (RUFTF – I’m still trying to figure out how that is pronounced).

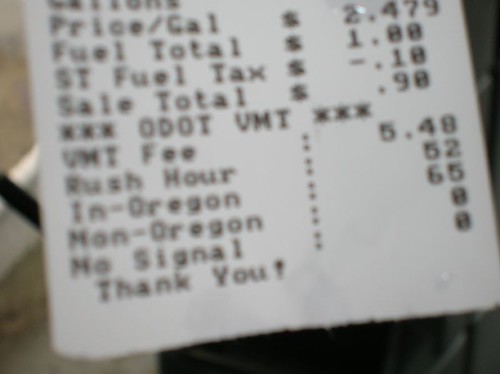

One of the outputs of that task force is a pilot program to test how we might collect information for a mileage-based tax, as opposed to a per-gallon tax. The advantage of a mileage-based fee being that it is not eroded as fuel efficiency improves. The pilot currently under way is not about policy (i.e., how to set pricing) but about the technology. On Friday I had a chance to attend an ODOT demo of how the information is collected (at the gas pump). Here’s the photo tour.

A few other points. The rush hour charge is not really a substitute for congestion pricing. For example the system cannot tell if you’re on a freeway or a local street (perhaps with different software?). It’s really there just to show that time/location based pricing is technically feasible.

Of course, I asked the big brother question. The ODOT folks tell me the data logger in the car only logs the category of location you’re in, not coordinates. I then asked if they would allow independent verification of the system to satisfy citizens that was true. They said they would (I don’t know if that’s official ODOT policy).

The purpose of this pilot, which has about 260 participants and runs for a few more months, is really to prove out the data collection technology, which it seems to have done. Policy choices come later…

13 responses to “Piloting a VMT Tax”

Why the hell can’t we just raise the gas tax? The cost to implement this system instead will be huge. Also, shouldn’t fuel-efficiency be rewarded? Taxing per-mile instead of per-gallon is an incentive to pollute. And are people who hate gas taxes going to be happier with wireless government doodads in their trucks?

I see two major benefits of such a program:

1. The gas tax should remain, but as a “pollution tax”. Along with this, there are no more exemptions (i.e. off road vehicle) – if you burn gasoline/diesel/etc., you pay the pollution tax based on the amount of pollution put out.

2. The RUTFT (Ruff Tough?) should include many more variables, such as classification of roadway. That way the revenues are apportioned out based on whether the street driven on is a city street, county road or state highway (and within state highways, secondary, primary or Interstate). Along with peak and off-peak hour in the metro areas (Portland, Salem, Eugene, Medford and Bend) but not outside those areas.

And I’d go a step further with a higher rate for the mountain pass roads (snow removal recovery fee).

I know a person who had their windows smashed and the only thing stolen was this system…

And raising the gas tax, while not only politically unpopular, does not meet the needs as we move to more fuel efficient vehicles, or vehicles that don’t use gas.

We cannot even maintain roads now – if fuel efficient vehicles or electric vehicles start taking off in popularity, the gas tax revenue will plummet. But the roads will still need maintenance.

The one thing that this system does not address, which a gas tax does sort of address, is the fact that more fuel inefficient vehicles should pay more. Especially when most of the least fuel efficient vehicles are the heaviest and thus do the greatest damage to roads.

It is going to be a tough problem to solve. People universally think roads suck, but also almost universally oppose raising gas taxes to improve them.

Why the hell can’t we just raise the gas tax? The cost to implement this system instead will be huge. Also, shouldn’t fuel-efficiency be rewarded? Taxing per-mile instead of per-gallon is an incentive to pollute. And are people who hate gas taxes going to be happier with wireless government doodads in their trucks?

Because the gas tax is utterly unfair and not representative of actual usage or costs. It is a very badly implemented and utilized tax.

Taxing per-mile vs. per gallon IS NOT AN INCENTIVE TO POLLUTE. The basis of pollution is whether a car is ULEV or not, it has nothing to do with the mileage it gets. One car could get 10 miles per gallon and be less polluting than one that gets 50. These things should not be incorrectly tied. If you want to punish polluting, find a way to do that, but don’t associate something that may or may not be true, because then the may nots get screwed.

Fuel efficiency should be rewarded by the fact that IT IS MORE EFFICIENT. I hate these continued propositions that a tax be put in place to coerce, manipulate, or outright force someone to use or not use something. It’s is morally sickening. Taxes pay for services we use, we should all pay our representative cost, if we can’t pay it we’re not being paid enough or working enough or worth enough to society to deserve it. Don’t confuse this situation more by adding the social engineering concept… then all you do is add fuel to the fire of the anti-whatever mode debate.

…and yeah, people are gonna complain either which way. Another reason the Government should setup rules of play, and get the hell out of the transportation industry.

My main objection to this is that there is a fundamental tension between a system that is private and a system that is auditable, and the scheme as currently implemented does not resolve this tension.

If indeed there is no “big brother” component and the system does not log actual coordinates, then it becomes less possible for a driver to “prove” an error – for example, driving near a state border (Oregon/California has a couple of border towns) and being charged for in-state when they were really out-of-state.

My secondary objection is that this tolling scheme does nothing to differentiate between heavy vehicles that do more damage to the road (and often take up more room, thus lowering slightly the capacity of a given lane) and smaller, lighter vehicles, as well as reducing the incentive the gas tax offers to fuel-efficient vehicles and driving practices.

My last objection is cost: Even if you had Garmin make this thing in quantity using off-the-shelf components, it would probably cost at least $200 per vehicle to outfit and install, not to mention the cost of retrofitting every gas station.

On my car, $200 is 36,000 miles of gas taxes — my warranty would be partly expired before the state would ever recoup the cost.

(Put another way, Oregon’s gas tax is 24.9 cents per gallon. $200 would mean 803 gallons of gas under the current revenue structure.)

I propose a simpler alternative:

Leave the gas tax pretty much as-is — it has a desired incentive for people to drive less and buy more fuel-efficient cars.

But, institute a “road maintenance fee” which is dedicated purely to maintenance of existing roads and is charged at registration time based on the miles driven, the weight of the vehicle, and the size of the vehicle, calculated in such a way as to be proportionate to the damage done and the space occupied. (By the way, this would mean that hybrid cars would pay for their additional weight over regular cars, which has been an objection based on the past. As a hybrid owner, I do support such an idea because it would be fair to all drivers.) Finally, as part of this road maintenance fee, charge an optional surcharge for drivers who wish to be certified to use studded tires — again this would be based on miles driven and estimated damage costs due to the use of tires. This would allow people who need or want the tires to continue to use them freely, but to pay a fair contribution to the cost of maintaining our roads.

– Bob R.

Why should a Toyota Prius (or any other hybrid auto) owner pay less for the use of a road as a non-hybrid Chevy Aveo, Toyota Corolla, Honda Civic, or other sub-compact car?

Why should a Escape Hybrid pay less for the use of the road than a Escape (non-Hybrid) – or a Toyota Camry, or Honda Accord or Civic?

I understand that because they are more fuel efficient (and less pollution) they should get a break off of the impact; but on the road they are still a car, that applies weight and contributes to congestion. They should pay the same on the road.

What happens when there are more and more hybrids on the road – road costs will go up and the revenue will go down. Let’s fix the inequality now, let’s use a weight-mile tax now on all vehicles, with smaller (more compact) vehicles will pay less per mile, AND will pay less in a pollution tax. Heavy SUV owners will pay more in both categories. THAT will be a sure-fire way to encourage people to purchase more fuel efficient cars.

Interesting laboratory test. Unfortunately, GPS mileage tracking is inherently flawed since the radio signals can be easily jammed by the fraudsters. Perhaps the “No Signal” line item would be the red flag tracker for ODOT?

Seems like too much technology for a statewide deployment though. A Curb weight/Annual mileage formula “road maintenance fee”, as BobR mentioned, seems like the best method for simplicity and general fairness. The gas tax can then be labeled a “carbon emission tax” and lowered/raised based on DEQ reports.

ODOT should just learn to live within its means, drop all its capacity adding projects (and staff) and focus on maintenance of existing lanes.

Voters were pretty clear last time around about this, and will not be impressed by complex technologies.

As roads become more crowded, people will make different choices about where to live, work and play and how and when to travel.

Any extra public resources should go to schools and universities.

Erik –

I don’t know if your comments were addressing what I wrote, but just in case…

I am not advocating that hybrid owners not pay their fair share. In fact, I’m arguing that all users pay their fair share based on vehicle size and weight, and estimated proportionate road damage and size of vehicle.

In addition, however, there are clear externalized costs to oil consumption in a variety of areas, and the gas tax provides a natural incentive to reduce oil consumption. Removing the gas tax and taxing solely based on miles driven would completely remove this natural incentive and inherently penalize those who have elected to consume less.

Thus, I propose a mix of taxes – use the “maintenance” tax idea to clearly reflect the costs of driving on existing roads, and use gas taxes as a mixed source for other highway-related purposes (still being bound by the Oregon constitution for highway-related purposes) such as new capacity, safety improvements, etc., although I would argue in favor of extending those purposes to include more enforcement and more harm mitigation.

– Bob R.

Gas taxes are used to pay for roads, (contrary to any rumors you’ve heard otherwise.) I’d love to see a pollution tax used to treat asthma, plant trees, subsidize equipment upgrades, and etc, but that isn’t the system we have now, nor can we have it without a change to our constitution. As such, basically what this is, is a weight/mile tax, that only taxes you in the state. (I imagine that by the time our state makes it mandatory, that other states will be adopting it too, and so your out of state driving will go to those states…)

But burning a gallon of gasoline in a newish car is actually a relatively clean process. Mowing my lawn, for instance, is far worse than driving to work, even though driving to work uses a 2/3rd of a gallon, and my lawn mower uses about a cup.

I’m not advocating an elimination of the gas tax; rather that the method of roadway finance should be shifted away from the gas tax (which measures gallons of fuel consumed, which doesn’t do a very good job of measuring actual road use) towards a weight-mile tax, which more directly determines the actual use of the roads.

The gas tax should remain (albeit reduced significantly) as a pollution tax.

The effect is that motorcycles would be cheap to operate (since they consume little fuel and use very little roadway resource); while large SUVs would become expensive to operate (at 10-15 miles per gallon, plus their weight and size place a much larger impact on the roads).

The pollution tax would be dedicated to encouraging alternatives to pollution – whether it be mass transit, non-fossil fuel burning power generation, what have you.

I believe it was The Oregonian that stated a few weeks ago that a major source of air pollution is construction equipment – which is currently NOT taxed for the diesel they burn. A “pollution tax” would capture that impact.

Don’t confuse this situation more by adding the social engineering concept…

However, that is just another reason this type of system is wrong – I feel it is a for-profit business masquerading as government for the purpose of creating a national database to be sold to businesses and marketers.

Instead, I think if there should be any change to the gas tax, it should instead be assessed by the type of vehicle… the “small, fuel-efficient” types that another commenter trumpets would pay less than the SUVs and land boats that some people – lets face it – will continue to drive no matter what, because they feel they “have the right.”

Okay, i’d support keeping the gas tax as-is, and charging a road maintenance fee at car registration time based on weight times mileage. It still seems much simpler and more private than this techie stuff.

Under such a system people will have an incentive to register vehichles out-of-state, and manipulate their odometers, but we have laws about that already. We should expect to need to beef up enforcement somewhat. There will also be drivers who do a lot of driving out-of-state, who’ll get pissed off. Maybe they can choose to adopt this mile-tracking technology in order to reduce their fee. Or else some simpler technology …

I wonder, though, how this would be applied to the interstate trucking industry, whose trucks aren’t likely to be registered in Oregon but will put lots of miles on our asphalt. How are they currently charged for the use of our roads, anyway?